Sovos - Enterprise Compliance Software

Tax Identity Management

Collaborating to simplify and automate what was once a complex and manual workflow to reduce time spent on repetitive and knowledge specific tasks.

Each tax season, the managed service team at Sovos receives responses from recipients requesting an update to their tax identity information. In the previous workflow, the managed service team referred to a 35 page guide to help correctly process these simple requests.

The Process

Research and Discover

Documenting Artifacts

I began compiling different artifacts from the existing solution to begin understanding the challenge that lay ahead.

As-Is Journey

By researching and mapping out the existing flow, I created a user flow map that spotlighted the highs and lows of the user experience.This user flow map helped build a base understanding for all stakeholders on the issues we were solving.

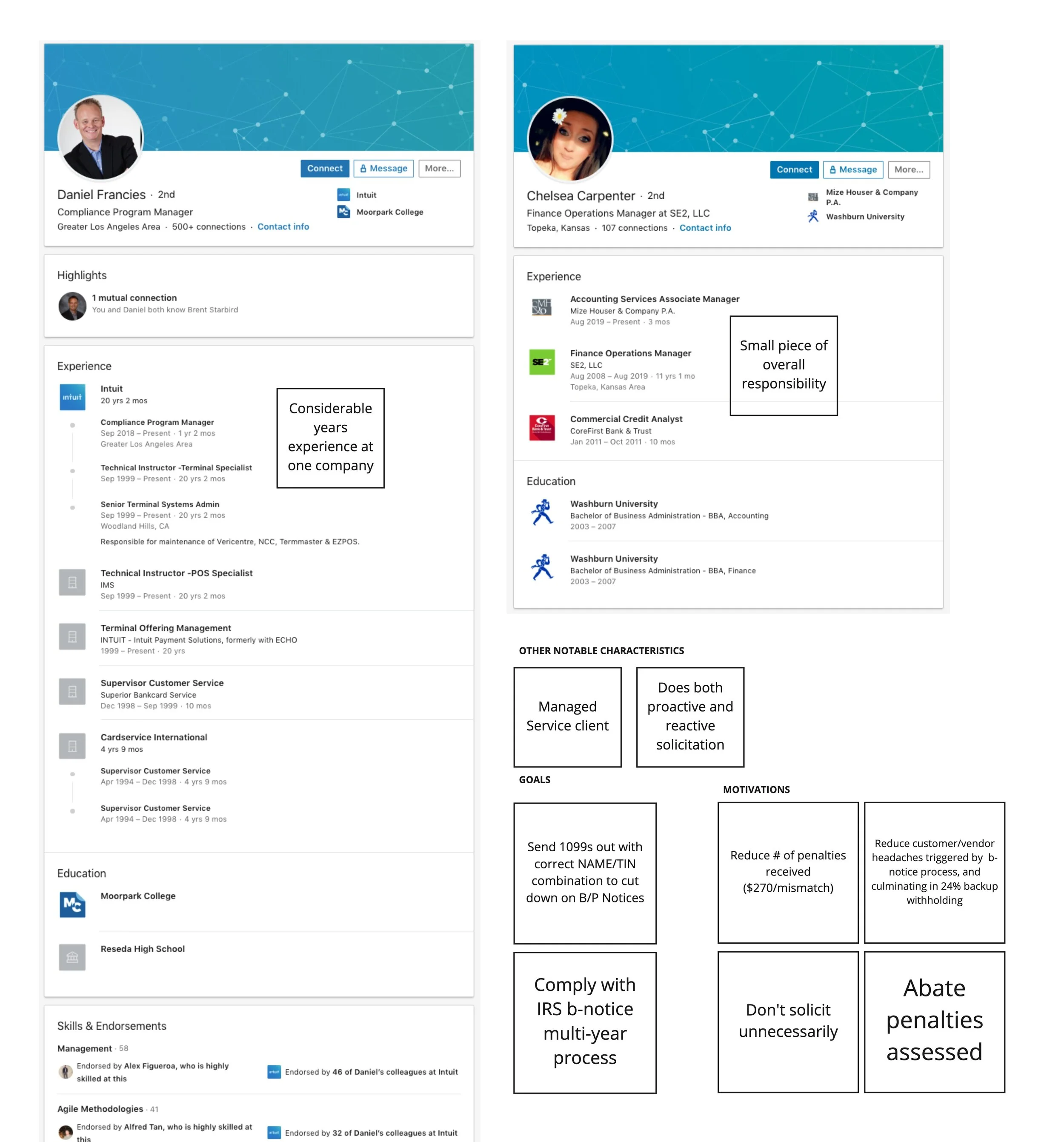

User Personas

After speaking with the managed service team members and understanding their roles further, I created two main personas for the project that we needed to solve for.

Implementing Design Thinking Workshops

Now it was time to gather the tiger team of subject matter experts. This included managed services managers, new hires, data architects, developers and product managers. Each member of the team was valued and encouraged to share their unique perspective on what the actual core of the issue was and how to best solve it.

At the end of the workshops, we identified the following W.O.W. statement to work towards.

“Jonathan, a newly hire compliance services representative can confidently and correctly process a tax identity response on his first day without having to leave the product.”

As with any project, we had to prioritize how to reach that goal with the limited resources we had. While we couldn’t implement every solution we dreamed up in the design thinking workshop, we could pick and choose what to do this year and also how to best set us up for implementing the remaining projects in future years.

At the end of our workshop, we selected the following goals for this year’s projects:

Reduce the amount of manual work from 80% to 20%.

Build in the 35 page guide into the product logic

Iterating at a Low Cost

Having established what the problem was and our end goal. It was now time to figure out the fuzzle part in the middle.

Using a 30/60/90 framework, I created the ideal workflow, keeping in project goals we aligned upon in the workshops. This was iterated in collaboration with the team to create the information architecture and user flow. During the iterative process we discussed necessary validations, error handling, and potential edge cases.

After aligning with the team that this was the basic informational architecture, I began wireframing concepts to begin user testing at the 60 level. Since the designs we shared with users were not pixel perfect, their feedback was focused on the ability to solve their needs.

Testing our Solution

Next we took each page from the workflow and created a medium fidelity mockup that was linked using Invision to create a prototype. This prototype was then tested with our managed services team in a moderated user test. We conducted two rounds of this testing, taking notes and iterating based on feedback.

Crossing t’s and Dotting i’s

Once we were confident with our solution, we could bring the mockups into high fidelity using our design system components. At this stage I collaborated with the content team and subject matter experts to ensure that we're using tax compliant language and terminology.

Finally, specs of the high fidelity designs were put together for designs for our development team.

Final Deliverables

01

A solution that allowed a new hire to confidently and correctly process a response without having to be a tax expert

The final solution is in the product and helped our Managed Team successfully process tax identity responses. We also could archive the user help guide to the joy of many existing managed services team members.

02

A product roadmap for future tax years that builds on top of what we have built.

By documenting our work during the design workshops, we have a path forward for features that would further automate and simplify this workflow for future tax years.